We've got the strategy ready for the week, but we're also looking at an introduction to options trading!

This will be a multi-part series, however we hope it helps you get started with everything options-related.

We've also started introducing our trade ideas via PokPok chicks, too! 🔥

Let's dive in... 👇

WHAT’S HAPPENING? ⌛️

- (September 26) GDP Growth Rate QoQ Final 🚨🚨

- (September 26) Fed Chair Powell Speech 🚨

- (September 27) Core PCE Price Index MoM 🚨

- (September 27) Personal Income & Spending MoM 🚨

Today's Micro-Lecture will prep you for understanding our trade ideas based on options strategies. This allows you to have a leveraged take on the market, with limited downside!

Coming up this week ⭐️

US Economic Events this week 📊

Seems like last week's 50bps rate cut was well-received. To boost Market Liquidity further, so that we can get some better price action, we'll need the following:

- Positive economic reports

- Consistent rate cuts

- Measured rate cuts (not too much: 25-50bps)

We want a healthy, growing economy, without increases in Inflation over the next 6 months.

We're currently targeting an EOY Interest Rate of 4.00% for December.

This means we've still got ~100bps to cut by the end of the year, a projected 2x50bps cut. This is given by CME FedWatch.

It's important to take news like the above with a pinch of salt 🧂

"Arthur Hayes boldly stated that risk assets, including cryptocurrencies, could crash a few days after the first Fed rate cut, which is expected to be announced on Wednesday."

Even if this does pose true, we believe that further intervention in preventing a wide-scale market crash and US Recession should be stopped. We should allow volatility to take over the system so that it can correct any mistakes we (the economy) have made over the past few years.

This will only happen if we allow it. But for now, let's go with our biases, and that's The Liquidity Cycle.

(September 26) GDP Growth Rate QoQ Final

- What this means: GDP Growth Rate is one of the staple indicators for the Fed in understanding the growth of the US economy. More growth = more appetite for risk (yes, like Bitcoin 😄). The converse would mean the opposite, less appetite for risk. Robust GDP Growth should be coupled with lowering inflation to reduce risks of further economic tightening.

- Prior/Forecast: 1.4% Prior / 3% Forecast

This Quarter's Growth Rate has been quite high, over double the last reading! This does give us confidence in the market, however, this must be healthy growth for rate cuts to continue. 🔍

(September 26) Fed Chair Powell Speech

For Powell's Speech this week after the GDP Growth Rate is announced, we're looking for wording around the healthiness of the past quarter's growth within the economy.

(September 27) Core PCE Index MoM

- What this means: Core PCE represents Personal Consumption Expenditures excluding Food/Energy prices and is the preferred fed inflation gauge. Lower PCE = Less Inflation (and vice versa).

- Prior/Forecast: 0.2%% Prior / 0.2% Forecast

(September 27) Personal Spending & Income MoM

- What this means: Key insight on the consumer market and its growth.

- Prior/Forecast:

- Personal Spending: 0.3% Prior / 0.4% Forecast

- Personal Income: 0.3% Prior / 0.4% Forecast

As we enter QE, we should expect Spending to increase as rates decrease which makes products more affordable for people. However, income is the report that is detached from interest rates (for the most part), which indicates actual growth related to the Consumer/Labour market.

We want to see a strengthening consumer market, however, we'll likely only see the impacts on lowered rates after a more significant decrease to 4.00% or lower (next year).

The Thesis 👀

- Bullish Thesis: Assuming GDP Growth comes in as or over expected, coupled with a positive note from Powell, we're likely to see a positive market reaction as the US heads towards a Quantitative Easing (QE) mode. 🔥

- Bearish Thesis: Lower than expected GDP Growth + uncertainty given by Powell. This shouldn't be the case given the confidence for a 50bps cut. 🐻

A Quick Strategy Update 💆

👇️ Recap of Friday’s Market Analysis & Key Levels below 👇️

Highlights

- A couple of hours ago, we hit our targets for the week on both BTC and ETH.

- Our limit orders automatically closed a few Short Term long positions at the marked levels (TP). Always take profit. 👀

- This was coupled with a spike in ETH/BTC to start the week off.

- Given this, we're looking for a continuation to ~0.043 as mentioned last week.

-> Sell higher for BTC to get more Bitcoin.

-> Trade the ETH/BTC range (0.041 - 0.043) to accumulate BTC in the process.

This is assuming you are happy to hold ETH or BTC in the long term regardless of its value, but allows you to profit from the discrepancies in value.

BTC Summary

- Our main target high for the week is 66,900, which may be possible following a positive GDP Growth report + Powell speech.

- We have a Weekly nPOC at 61,170 which is a high probability level of hitting within the week.

- Due to the amount of stacked levels in this area, we expect it to be a high reaction zone.

- This is a key level to long from.

- Weekly Targets 👆️65,300, 66,900, 68,200

- Weekly Target 👇️ 62,400, 61,170

→ CONDITION: Strong reaction around the key level, 30 min close above

→ As we're dealing with an option that can only be exercised at expiry, we'd prefer to pay less upfront, and abandon the option if it doesn't go our way, this is essentially our Stop Loss.

ETH Summary

- Similar to BTC, we're expecting a high probability pullback which poses a great long opportunity!

- Weekly Targets 👆️ 2840

- Weekly Targets 👇️ 2473, 2430

-> CONDITION: Strong selling reaction once hit the current high

-> Take Profit: 2600, 2440

-> Stop Loss: Above the 30m high wick for selling.

This should allow for a high-risk-to-reward trade!

-> Event: GDP Growth Rate QoQ Final + Fed Powell Speech (26 September)

→ CONDITION: As expected or more than expected (>= 3%) + wait for 30 min close after the GDP report. If the price exceeds the 30 min high of the initial candle, buy your chick!

→ As we're dealing with an option that can only be exercised at expiry, we'd prefer to pay less upfront, and abandon the option if it doesn't go our way, this is essentially our Stop Loss.

, Event-based trades can be unpredictable, however, PokPok allows us to pay less upfront which reduces our risk overall while maintaining a high leverage!

Make sure to follow the conditions to maximise your chances of success!

Micro-Lecture

⭐ An Introduction to Options Trading (Part 1)

Welcome to Options! One of the Financial Instruments that 99% of retail don't know about, but can lead to some awesome opportunities.

From longs/shorts to even hedging – Options allow you to have leveraged and unlimited upside with limited downside.

You can only lose what you pay for the option, and you can also ditch the option as a "stop loss".

Introduction

- 1️⃣ Definition: A financial contract that gives the right, but not the obligation, to buy/sell an underlying asset. 🧠

- The lingo: When you close an option position in profit, you are exercising it.

- 2️⃣ An option is leveraged as it allows you to buy an asset for a small premium, as you are borrowing the right to buy/sell, not owning the underlying. 😮

- 3️⃣ As you are "borrowing the right", there is a time limit, this is called your expiry. This could be anywhere from a day, to even a year! 👀

- 4️⃣ The underlying asset can be anything, from BTC, and SP500, to even Wheat!

- 5️⃣ For every option, there's a strike price, which is the price you are buying the right to buy/sell the underlying.

If a farmer wanted to buy Corn in a month @ $0.50 a kilo but was afraid of a shortage that would increase the price to perhaps $0.75 a kilo, he might buy a call option to secure his price to buy @ $0.50, allowing him to immediately sell into the market at the increased price.

If there is no shortage, all he loses is the premium he paid to "protect" himself.

If BTC goes up to $67,000, you make $2,000, meaning you've doubled your investment.

Types of Options

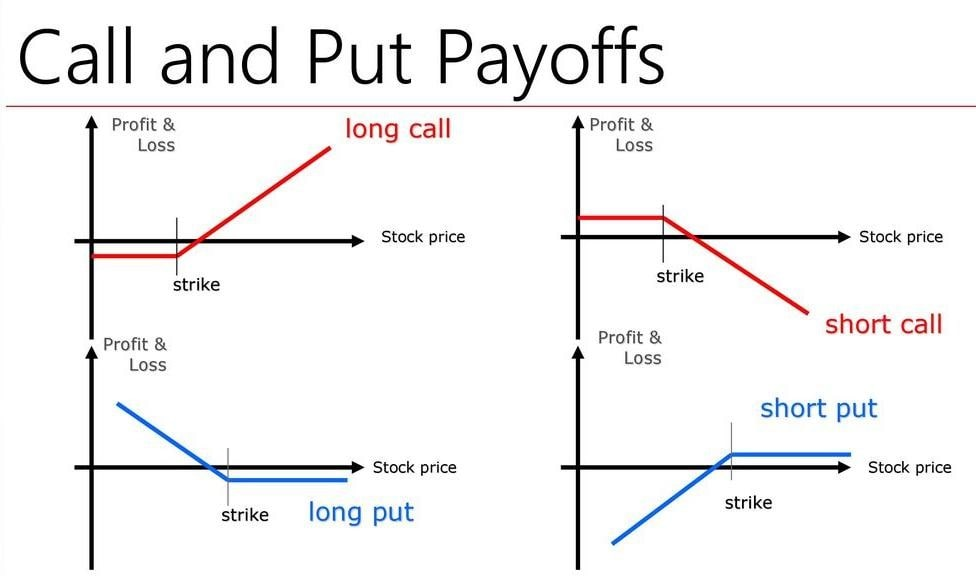

Call Options

- 👉 A Call Option behaves similarly to a long. You have a profit when the price rises above a strike price.

- 2️⃣ You can also sell/short a call option, which is where you receive the premium. This is a short trade which suggests you're betting the price won't go up past the strike price. (Be careful, these can have an unlimited loss as you pay for the buyer's profit.)

Put Options

- 👉 A Put Option behaves like a short. You have profit when the price falls below a strike price.

- 2️⃣ You can also sell/short a put option, which is where you receive the premium. This is a long trade which shows you're betting the price would fall below the strike price. (Be careful, these can have an unlimited loss as you pay for the buyer's profit.)

Payoffs Visualised

Option Styles

There are two types of options. There's only one key detail you need to remember, so we'll keep it simple!

- European Options: You may only exercise an option at the expiry date.

- American Options: You can exercise the option before the expiry date. (Sometimes these options can be a little more expensive due to the added benefit.)

However, the difference here is that you do not pay the premium fully upfront, which allows you to stop paying as a "stop loss" strategy, and only fully commit to a successful option.

For details, read our docs!

Key Concepts of Moneyness

An option can be in three key states. This is called the moneyness of the option:

- In-the-money (ITM): This option is in profit (in terms of the strike price).

- Call Option: Above strike

- Put Option: Below strike

- Out-of-the-money (OTM): The option is not in profit (in terms of the strike price).

- Call Option: Below Strike

- Put Option: Above Strike

- At-the-money (ATM): The option is at the strike price (roughly).

- An option underlying isn't usually exactly at the strike price, so we just estimate (roughly).

Basics of Pricing an Option

We won't go into this in detail today, however, there are a few things that make up the value of an option.

- Intrinsic Value: How much in the money the option is (e.g $200 above strike)

- Time Value: How much time before your option expires.

- Interest Rates: This has a little impact on your option but crypto platforms often remove this factor.

- ⭐ Volatility: This is by far the most important factor in pricing an option. Volatility (calculated mathematically) determines the chances of the price moving towards a certain expiry. 🔥

- This changes constantly, as is also why far OTM options are priced extremely cheap, there's a lower probability of it expiring in profit.

Search this up for a better understanding. But we'll go into this in a little more detail in the future!

We're taking it a step at a time. It's a lot to digest. 😄

Get in touch with at contact@tagoresearch.com or pop us a message on X at @tagoresearch.

Discussion