Good Morning everyone!

Not quite an October Morning (just yet)

Let's get into it!

WHAT’S HAPPENING? ⌛️

- (September 30) Fed Chair Powell Speech 🚨🚨

- (October 4) Unemployment Rate MoM 🚨🚨

- (October 4) Non-Farm Payrolls MoM 🚨🚨

Coming up this week ⭐️

US Economic Events this week 📊

We continue into the exploratory phase for Quantitative Easing. As mentioned last week, we're looking for these for a healthy, growing US economy:

- Positive economic reports

- Consistent rate cuts

- Measured rate cuts (not too much: 25-50bps)

(September 30) Fed Chair Powell Speech

Unlike last week, today's Powell Speech is focused on the US Economy.

We're expected to hear projections regarding how low interest rates may fall in the coming months. Primarily for investors, it's about easing any uncertainty around November's cuts.

This will be reflected through the CME FedWatch website. At the moment a 50 bps cut is favoured @ 54%.

This week's events are going to have an impact.

(September 27) Unemployment Rate MoM and Non-Farm Payrolls MoM

- What this means: Non-farm payrolls is a key economic indicator that measures the number of jobs added or lost in the US economy over the previous month, excluding farm workers. The Unemployment Rate is the degree of unemployment in the economy.

- Prior/Forecast:

- Unemployment Rate: 4.2% Prior / 4.2% Forecast

- Non-Farm Payroll: 142K Prior / 145K Forecast

The Thesis 👀

- Bullish Thesis: We'd like to see a continuation in easing the labour market as we've only had a 50bps cut. Hence, an unemployment of 4.2% or higher. Then, an NFP of 145K or lower. This would suggest the Fed carry out further cuts sooner as there is some catchup to be made from the labour market. However, an overwhelmingly positive result which may come oppositely would bring up investor confidence. (e.g: 4.0% UE, 300K NFP) 🔥

- Bearish Thesis: The converse would push us towards a more neutral stance than bearish, as it's likely the Fed is looking for a confirmation bias of deeper cuts than something to prove against their theory. 🐻

A Quick Strategy Update 💆

👇️ Recap of Friday’s Market Analysis & Key Levels below 👇️

Trade Follow-up - (Event-based Long Chick @ GDP Growth)

- Review: This chick closed ~$900 above the strike. From the full cost of ~$1530, and the given weekend range, we would've had to consider either stopping paying for the option or minimising any losses, as it would be uncertain whether we'd get a further breakout.

- Return: If you exercised the option in the end, you would've come at a $630 loss as opposed to $1,020 if you had stopped paying for it.

If you're keen on this too, we'd appreciate it if you filled in this quick form!

BTC Summary

- We hit our downside target of ~64,400 a few hours ago. This is our line in the sand before closing any of our longs to look for lower levels.

- This is a key long to take right now.

- Again, if we close below the Daily level on the chart, we'll be looking for our downside targets for the week.

- We had a strong reaction there so we're looking for a retest back into the 50k area. Take this as a restest of the previous range high which is healthy. If we accept above this area, we'll likely continue to higher highs.

- Just for reference, we had a Weekly nPOC @ 64,400 (our target), which did hit. This gives us confidence that there isn't much pulling us down for the week, other than potential Economic Report uncertainty.

- MAIN WEEKLY TARGET: 66,900

- This is the same as last week as we haven't cleared it yet.

- Weekly Targets 👆️65300, 66900, 68200

- Weekly Target 👇️ 63200, 62500, 61200

-> CONDITION: If stop loss hasn't been invalidated af time of reading.

-> Take Profit: 66000, 67000 (~2-4% profit)

-> Stop Loss: 64,000 (1% loss)

High risk-to-reward! 🚀

ETH Summary

- Ethereum has been a little more chaotic last weekend.

- We've also hit our weekly VWAP which was estimated on the Friday, but went on to hit a geometric level below.

- This is a bit more difficult to take long on right now, however, if any other lower levels hit, there may be better opportunities.

- Weekly Targets 👆️ 2693, 2768, 2840

- Weekly Targets 👇️ 2580, 2473, 2430

-> CONDITION: Strong buying reaction once hit the current high

-> Take Profit: 2650, 2765 (~3 to 7% profit)

-> Stop Loss: Below the 30m close wick when buying. (up to ~0.75% loss

High risk-to-reward! 🚀

Micro-Lecture

⭐ Options Trading (Part 2)

A continuation of last week's options introduction, we'll be introducing two new options strategies and the Greeks. If you haven't read the first part, please do so now.

New Ideas

- 1️⃣ Options Greeks: You might have seen on an Options Platform that there are some funny-looking Greek letters. There's are called Options Greeks! These are important for analysing an Option's profitability and value.

- This can be quite complex, and you won't always be using this, but we think it's important you have a basic understanding of what affects the pricing of an option!

- 2️⃣ Implied Volatility: As briefly mentioned last week, Volatility is one of the most important factors that impact options price. It changes constantly.

- The longer the expiry date, the higher the potential volatility in the future (the price may have more time to move, or is expected to move during that period).

- This means that not only you are paying a premium for more time, but also a potential movement in price.

- You can also benefit from this. If you think the volatility of an asset will increase... you can bet on this! Or conversely, if you think the volatility will decrease... you can bet on this too!

- This is known as Long or Short volatility, or vega!

Options Greeks

- Delta (Δ)Measures how much the price of an option will change for a $1 move in the price of the underlying asset.For call options, the delta is positive, ranging from 0 to 1.For put options, the delta is negative, ranging from -1 to 0.HIGHLIGHT: You can also interpret this as the probability of an option expiring in the money (ITM).Example: If a call option has a delta of 0.6, the option's price will rise by $0.60 for every $1 increase in the underlying asset’s price. It may also have a 60% chance of expiring ITM.

- Gamma (Γ)Measures the rate of change of delta relative to changes in the underlying asset's price.Gamma is highest when the option is at the money (ATM) and decreases over time.Example: If gamma is 0.05, and the underlying asset moves by $1, the delta will change by 0.05.(This is why an option that is far out of the money, won't increase much in value from a price movement).

- Theta (Θ)Measures the time decay of an option, i.e., how much an option’s price decreases as it gets closer to its expiration.Theta is usually negative for both calls and puts since time decay erodes an option's value.Example: If theta is -0.05, the option’s price will decrease by $0.05 each day, all else being equal.

- Vega (ν)Measures how sensitive an option’s price is to changes in implied volatility.Vega increases with longer expiration dates and when the option is at the money.Example: If vega is 0.10, and implied volatility increases by 1%, the option price will increase by $0.10.

- Rho (ρ)Measures the sensitivity of an option’s price to changes in interest rates.Rho is positive for call options and negative for put options.Example: If rho is 0.02, a 1% rise in interest rates would increase the option’s price by $0.02.(In crypto this may not be as relevant as most exchanges don't factor in Interest Rates, as far as we're aware.)

Basic Options Strategies

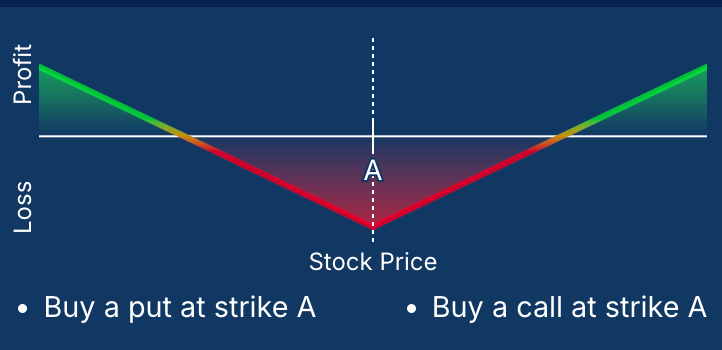

- 3️⃣ (Strategy) Straddle: A straddle is a long vega options strategy. You want the volatility of the price to increase.

- When to use: You'll use this if you see the price having a large move, but in either direction.

- Benefit: No need to predict where just roughly when a move may happen.

- This strategy has limited loss and unlimited gain!

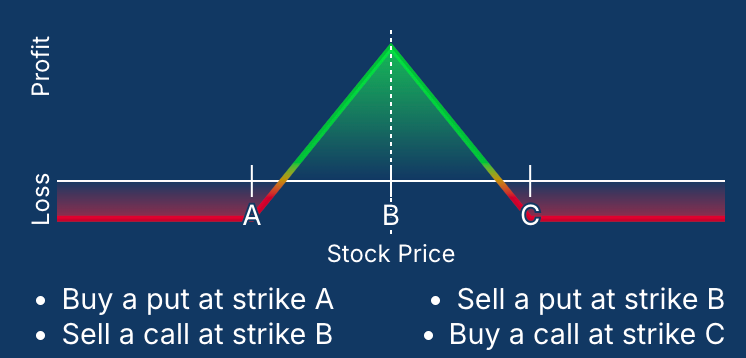

- 4️⃣ (Strategy) Iron Butterfly: This is the opposite of a Straddle (sort of). It's a short vega strategy. You want the volatility of the price to decrease.

- When to use: You'll use this if you see the price ranging and not breaking out anytime soon.

- Benefit: It doesn't matter where the price expires, it just matters that it doesn't expire outside of the range.

- Example: Last weekend was a pure range for BTC. We could've opened a small Butterfly spread and have been able to find a profit from a lack of volatility. Isn't that great?

- This strategy has limited loss and limited gain!

Get in touch with at contact@tagoresearch.com or pop us a message on X at @tagoresearch.

Discussion